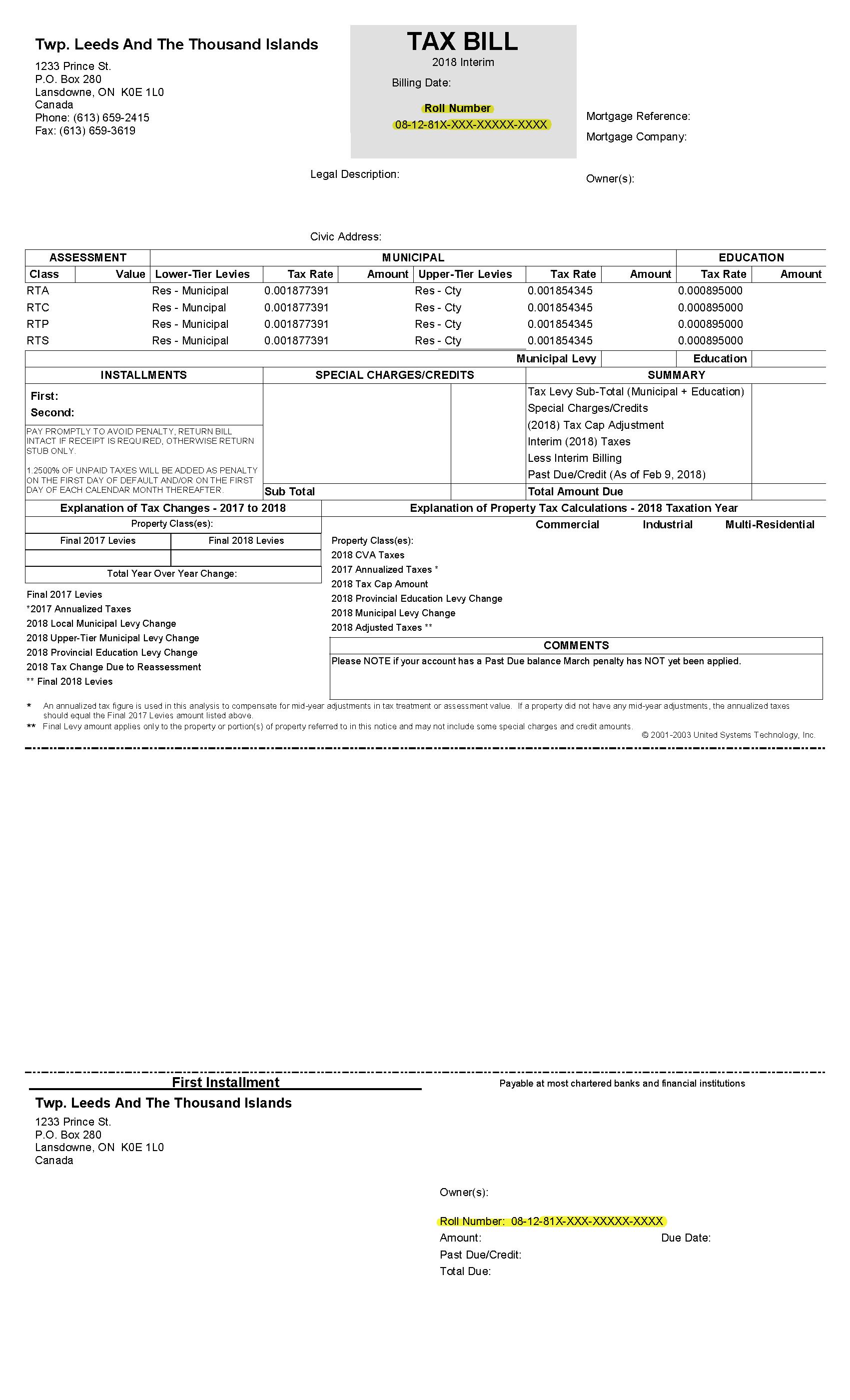

Check dates and deadlines for tax bill payment. There are several ways for you to pay your property tax bill:

| In person or by mail |

Please make cheques payable to "Township of Leeds and the Thousand Islands" |

| Online banking |

| Use "Leeds" to search for payee, then select "Leeds and the Thousand Islands, taxes" use your roll number as your account number, the last four digits may not be required. |

| Online through PayPal/credit card |

| Note: a 3% plus $0.35 convenience fee per transaction will be applied. Have your 19-digit roll number ready to create an account and make your payment. |

| Telephone banking |

| Add "Leeds" as a payee, use your roll number as your account number. |

You will require your 19-digit roll number to make a payment. Your roll number is located in two locations on your tax bill.